Happy New Year!

Happy New Year!

With the close of 2017, many people think about what the new year will hold and set fresh goals for the future. We often think about our goals related to our careers, self-improvement, and financial wellness. When you sit down to write out your goals for the future, I recommend thinking further into the future.

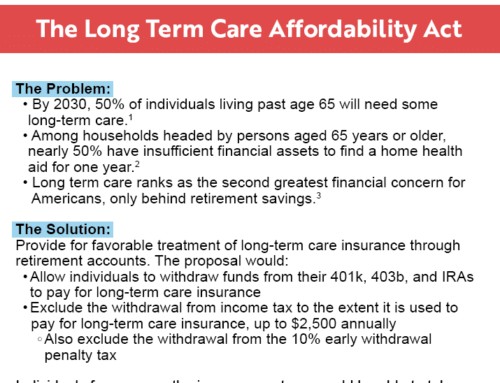

The topic of long-term care planning isn’t an easy one to consider and many people would rather put it off, but statistics show that 70% of Americans over 65 years old will need some form of long-term are assistance during their lifetime. Pair that with increasing life expectancy and it’s often no longer a question of if, but when.

In the new year, carve out some time to sit down and set a few goals for your future. Here are a few helpful questions to get you started:

What are my expectations for my lifestyle 10 or 20 years down the road?

- Have I considered exploring the possible long-term care options that would be available to me?

- What type of care would I prefer if I needed it?

- Do I have my estate planning and other legal documents in place?

- Have I thought about long-term care insurance and the asset protection it can provide?

The new year offers the promise of a clean slate and a fresh start. Starting to plan for your future and long-term care sooner rather than later can provide peace of mind, relieving the potential burdens of financial stress and other unknowns down the road.

Please do not hesitate to call or shoot us an email. I am looking forward to working with you on your financial goals for 2018!

Sincerely,

John F. King, CLTC

PS: To read more about long-term care insurance, I came across this article from Kiplinger, 4 Secrets to Buying Long-Term Care Insurance. Click below to find out how to get the best deal for you https://www.kiplinger.com/article/retirement/T036-C000-S004-4-secrets-to-buying-long-term-care-insurance.html