This is the most exciting public policy that I’ve witnessed in 20 years as an LTCi specialists. Funding options that we’ve been asking for over the last 2 years (see “Help Me Help You” previous post) is included in Senator Toomey’s new Long Term Care Affordability Act. I’ll copy the text below to replicate the image above. This has bipartisan support across the board. This changes everything, and should be a warning to anyone who doesn’t already have an LTCi plan. It is so important that the government is considering allowing you to take a penalty free/tax free deduction from your retirement plan to buy an LTCi plan. Mainly because the LTCi plan will end up protecting your retirement!! Very exciting!!

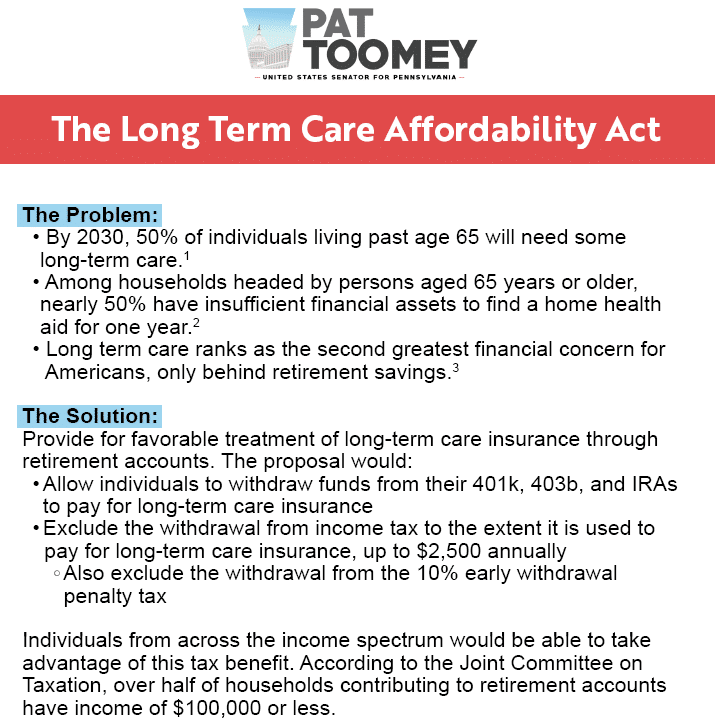

The Long Term Care Affordability Act

The Problem:

• By 2030, 50o/o of individuals living past age 65 will need some long-term care.1

• Among households headed by persons aged 65 years or older, nearly 50o/o have insufficient financial assets to find a home health aid for one year.2

• Long term care ranks as the second greatest financial concern for Americans, only behind retirement savings.3

The Solution:

Provide for favorable treatment of long-term care insurance through retirement accounts. The proposal would:

• Allow individuals to withdraw funds from their 401k, 403b, and IRAs to pay for long-term care insurance

• Exclude the withdrawal from income tax to the extent it is used to pay for long-term care insurance, up to $2,500 annually. Also exclude the withdrawal from the 1Oo/o early withdrawal penalty tax Individuals from across the income spectrum would be able to take advantage of this tax benefit. According to the Joint Committee on Taxation, over half of households contributing to retirement accounts have income of $100,000 or less.

1 U.S. Census Bureau, Press Release, “Older People Projected to Outnumber Children for First time in U.S. History,” September 6, 2018

2 2019 Genworth Cost of Care Survey, 2016 Survey of Consumer Finances

3 2019 Insurance Barometer Report, LIMRA

-John