Be careful who you take advice from…here is some from CNBC Personal Finance writer Carmen Reinicke :

If you’re in your 50s, you need to plan for long-term care right now

- Less than a quarter of high net worth individuals have plans for long-term care in place, according to a poll of advisors by Key Private Bank.

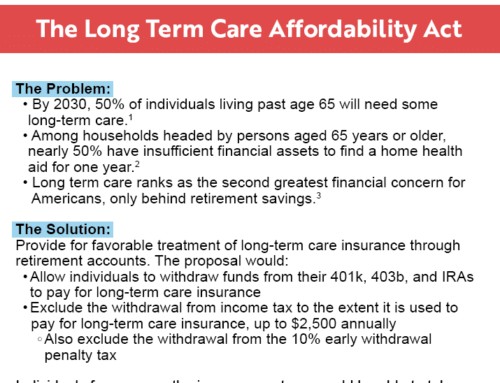

- Over half of people over 65 today will need long-term care at some point, according to AARP.

- Financial advisors and aging life care experts say to plan ahead for long-term care and communicate those plans with your family.

Carmen Reinicke |

CNBC.com

More money doesn’t always lead to more planning, especially when it comes to unpopular subjects like end-of-life care. Less than a quarter of high net worth clients currently have plans for long-term care in place, according to a poll of financial advisors by Key Private Bank, the wealth management arm of KeyCorp. The poll surveyed nearly 150 advisors about their experiences with high net worth clients, those with assets over $1 million.