Are you a Family Caregiver?

Most long-term care is provided unpaid by family members and friends. Over three-quarters (78%) of people living in the community (at home) who need long-term care get support exclusively from informal or unpaid caregivers such as family members and friends.

For many people, there is no hesitation to assist when it’s time to care for a loved one who’s lost independence due to health problems, old age, dementia or other reasons. Existing work-loads are rearranged, large sacrifices are made of time, effort and money, and the well-being of the loved one in need is given top priority. Often without little medical training or even much notice, these people rise to the unexpected challenge of maintaining another person’s health; eating, sleeping and bathing schedules, medical appointments and financial obligations.

Resentments may grow, leading to feelings of guilt and anger. With no relief in sight, these are common feelings among caregivers. Additionally, statistics tell us that in about 40% of caregiving scenarios with elders, the spouse providing the care will pass away before the patient, often dying from stress-related illnesses associated with caregiving.

According to the U.S. Department of Health and Human Services, about 70% of people turning 65 this year will require long-term care in the future…while I hope that you are in the 30% that doesn’t require these services, are you willing to chance your retirement savings based on these odds?

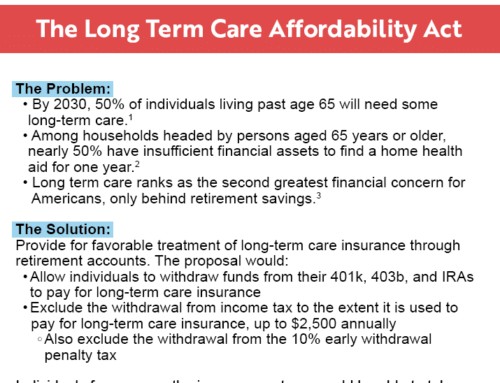

Let’s face it, healthcare innovation is increasing life expectancy, and as a result, the number of Americans who are age 85 and up, is growing much more quickly than the rest of the population. This means, we are increasing the risk of requiring long-term care during our lifetimes. That can be a big problem because long-term care costs thousands of dollars per month, and it’s not covered by Medicare or health insurance (as you may have seen already with your loved one).

The Motley Fool article, “Your 2017 Guide to Long-Term Care and Long-Term Care Insurance”, mentions that the most common reasons for needing long-term care are stroke, Alzheimer’s disease and cancer. Falls are also a major cause of fatal and non-fatal injuries in people over 65. And, while some patients won’t require a long stay in long-term care, roughly half of long-term care patients will require a stay that’s over one year. In those that require care more than one year, the average period requiring care is nearly four years. Can you afford to pay for your care for nearly four years?

It’s important to have a strategy in place. Long-term care costs can wipe out your retirement nest egg rather quickly. Having an in-depth conversation with your loved ones about your long-term care plan is critical to your (and their) financial security.

For more information regarding the options available to you, please call or email us.

Sincerely,

John F. King, CLTC